Reimagining wealth from the ground up.

Welcome to Assetly, where we empower you to take control of your financial future. Targeting Australian SMSF trustees and investors, our automated accounting, cashflow and investment technologies are aimed at simplifying your life and building your wealth, so you have time to spend it.

Reimagining wealth from the ground up.

Welcome to Assetly, where we empower you to take control of your financial future. Targeting Australian SMSF trustees and investors, our automated accounting, cashflow and investment technologies are aimed at simplifying your life and building your wealth, so you have time to spend it.

Are you part of the AU$1 trillion dollar SMSF industry?

If you have your own SMSF, plan to set one up, or manage a bunch of them, you will find the industry is disconnected and inefficient. Outdated technology and siloed products and services is limiting innovation in the sector, resulting in high costs and a poor user experience for each target market.

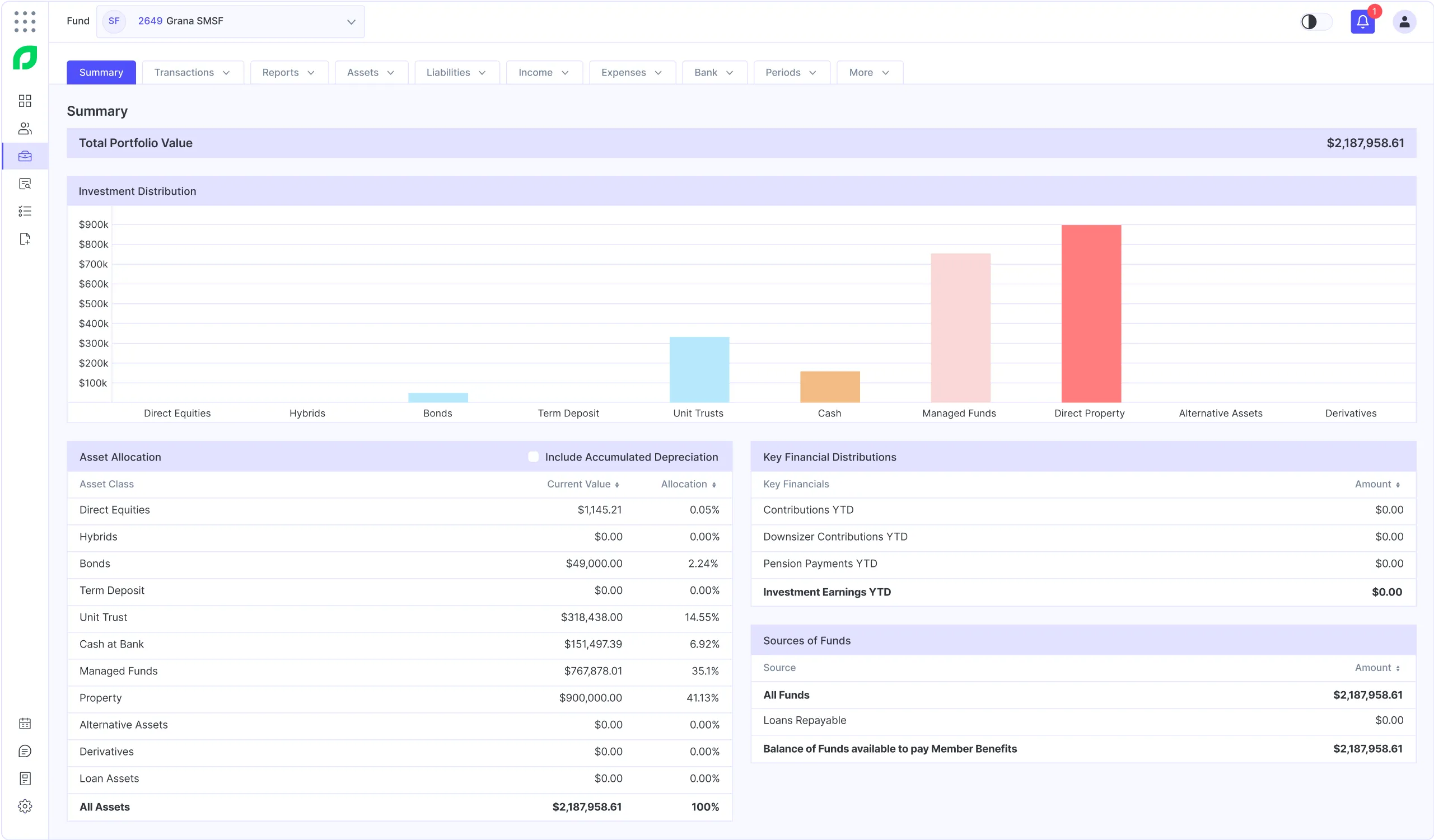

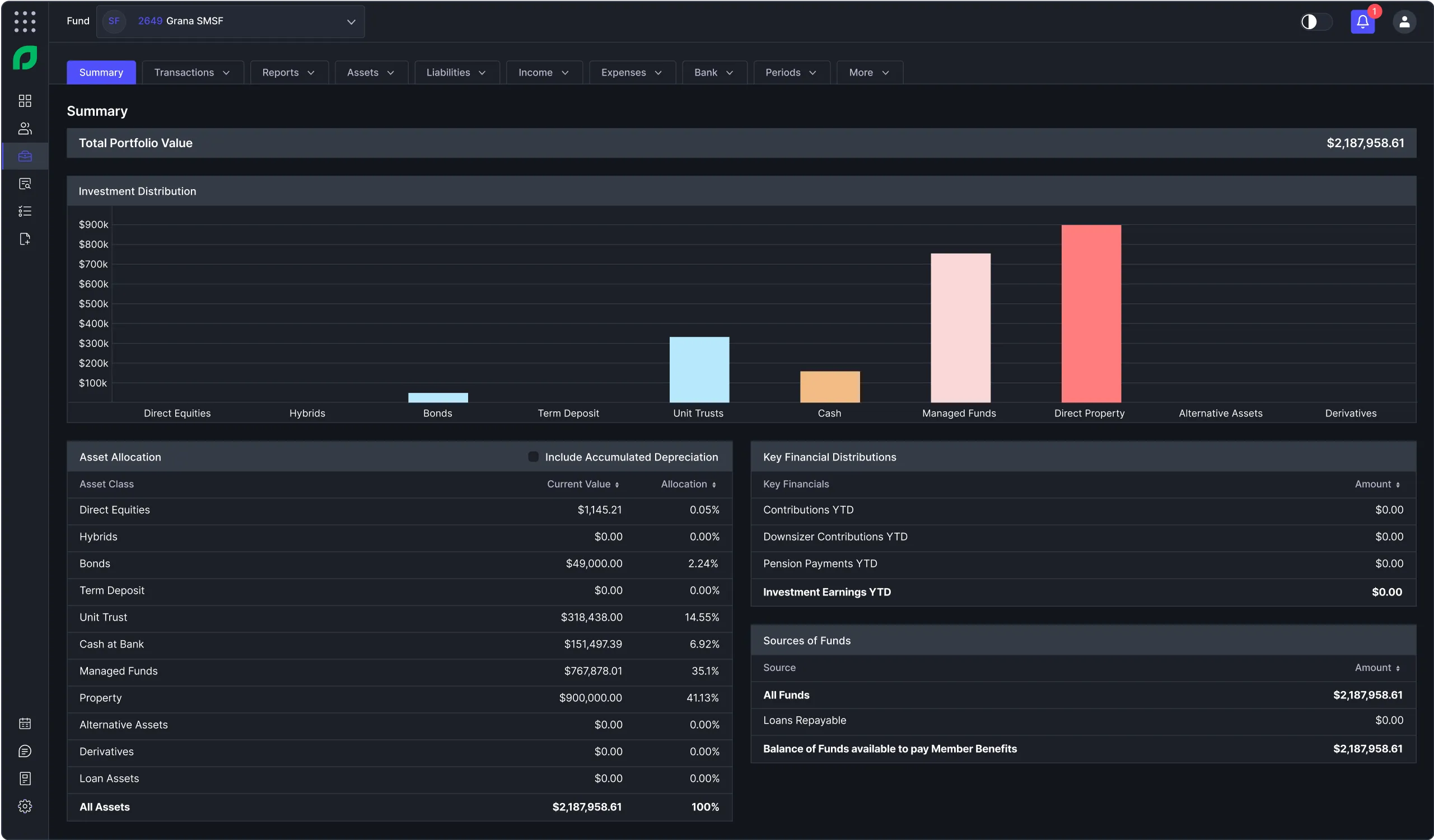

We automate your SMSF accounting, cashflow, payments and investments with AI

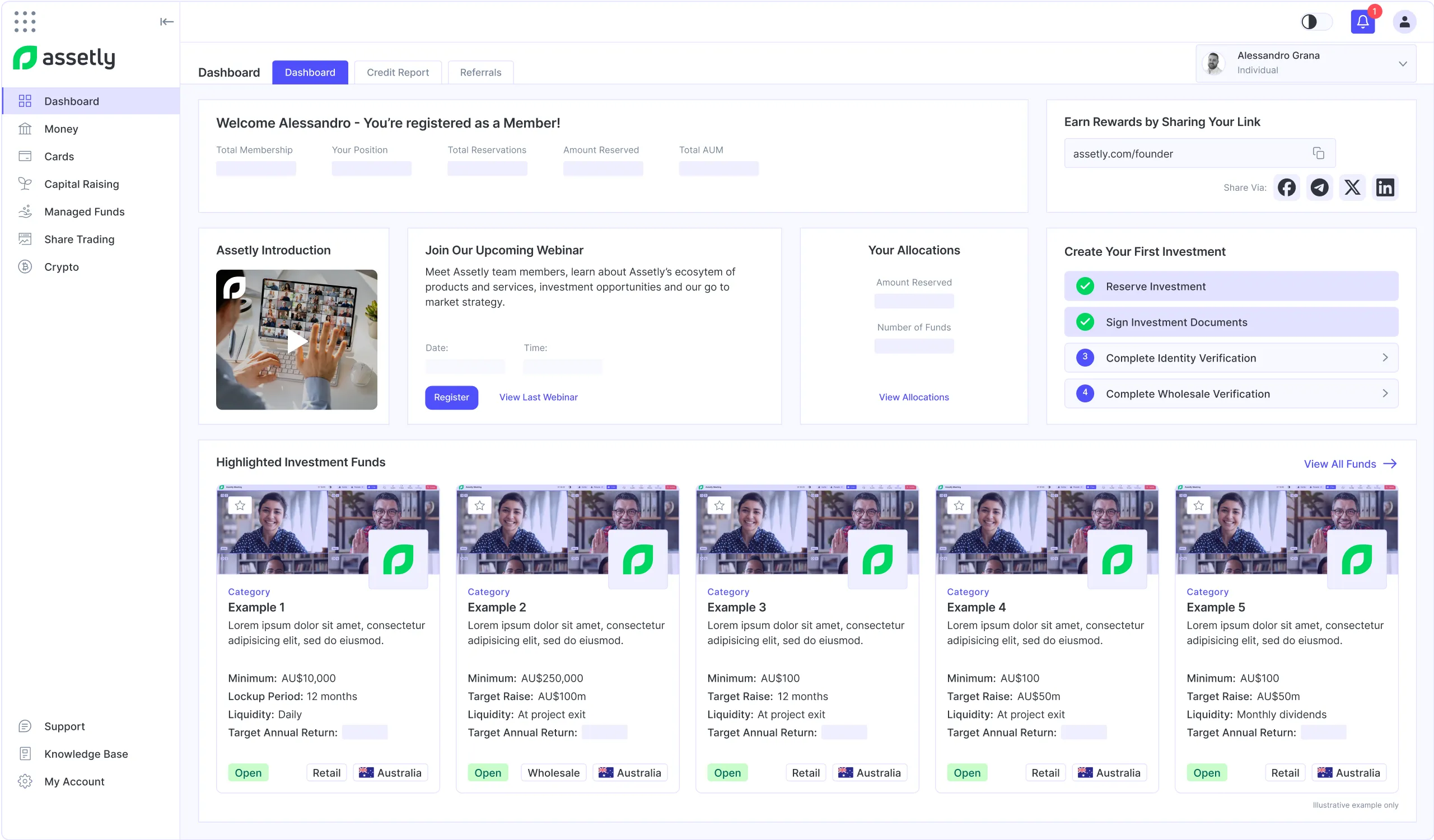

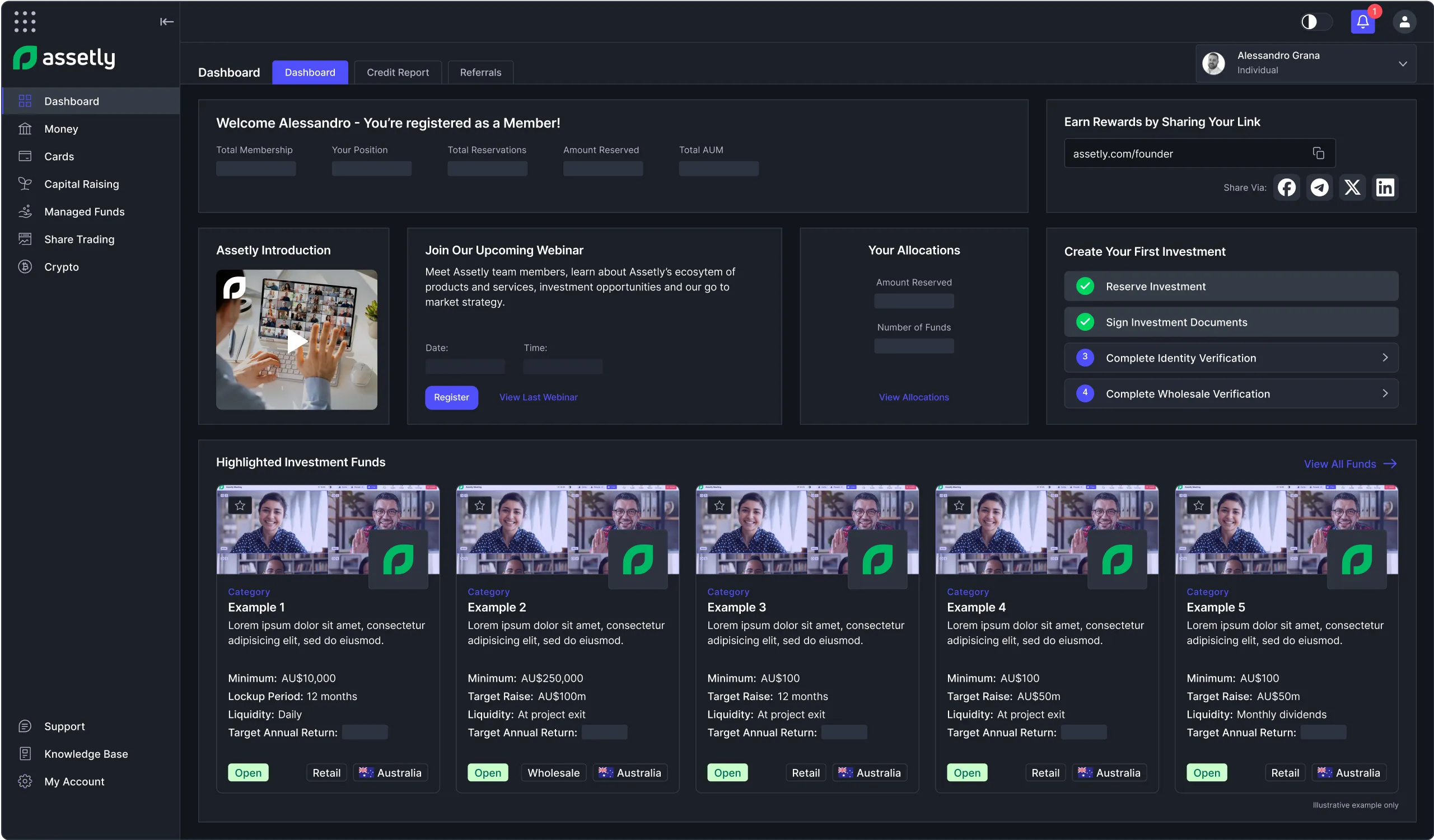

Assetly is building a premium investment ecosystem that aims to disrupt the traditional financial services industry through adaptive SMSF accounting, cashflow, payments and investment automation.

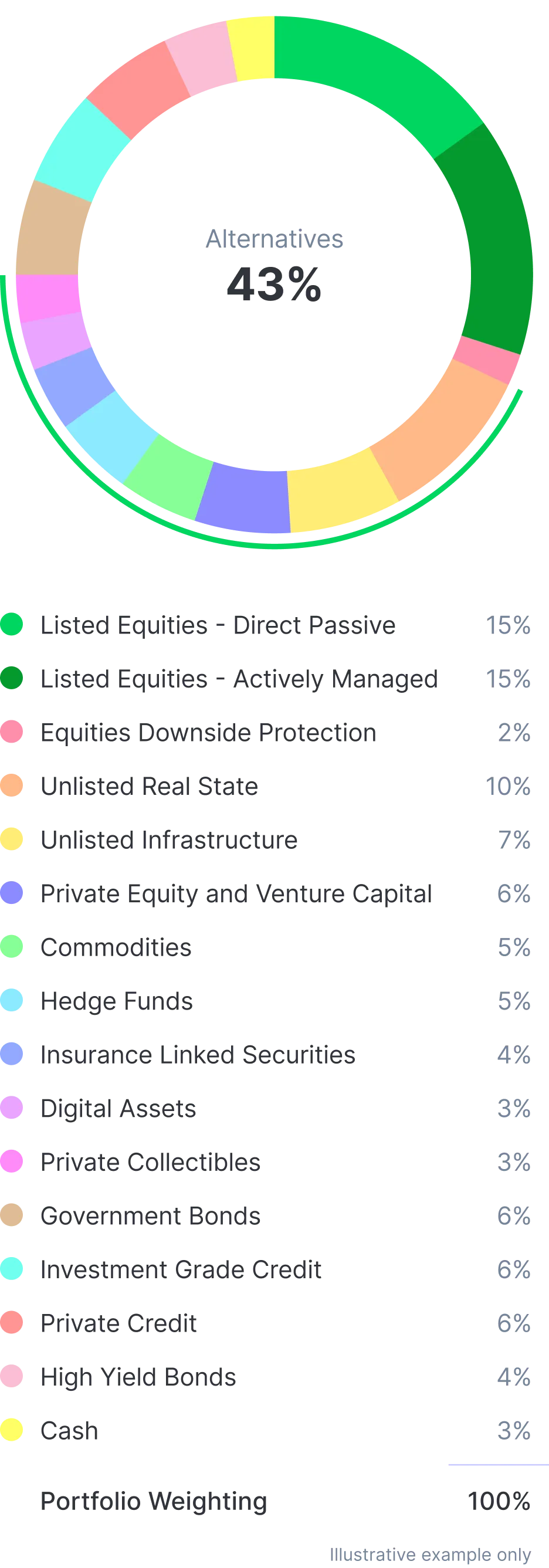

Enabling you to focus on building a fully diversified portfolio

With Assetly’s portfolio building capabilities, you can get fractional access to highly sought after investment strategies and emulate the portfolio structure of a family office with as little as a thousand dollars.

The Assetly Ecosystem is a powerhouse of innovation at your fingertips

Assetly’s last-mover advantage empowers us to build a next-generation platform that transforms the Australian SMSF landscape through cutting-edge innovation at the intersection of accounting and finance.

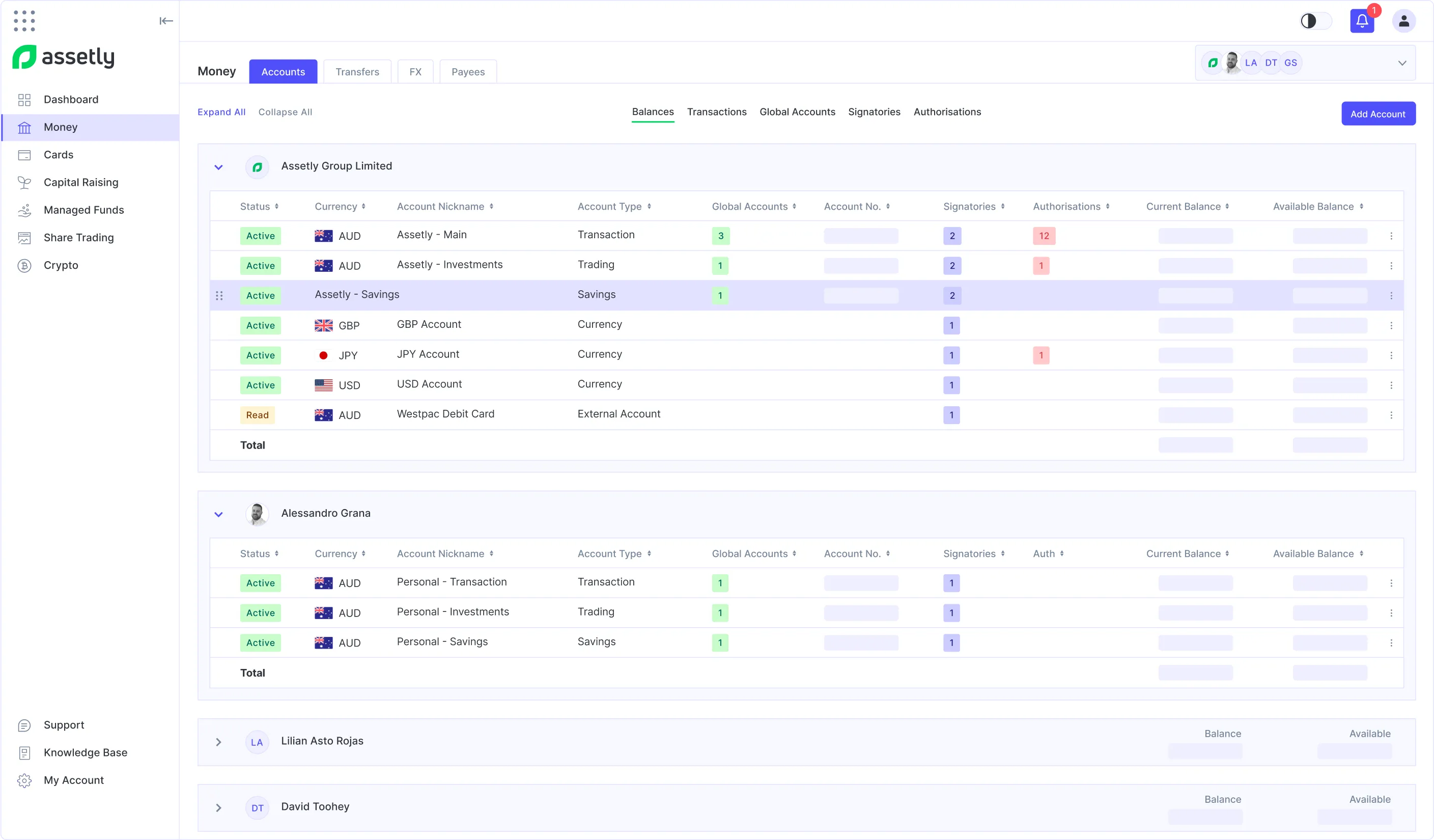

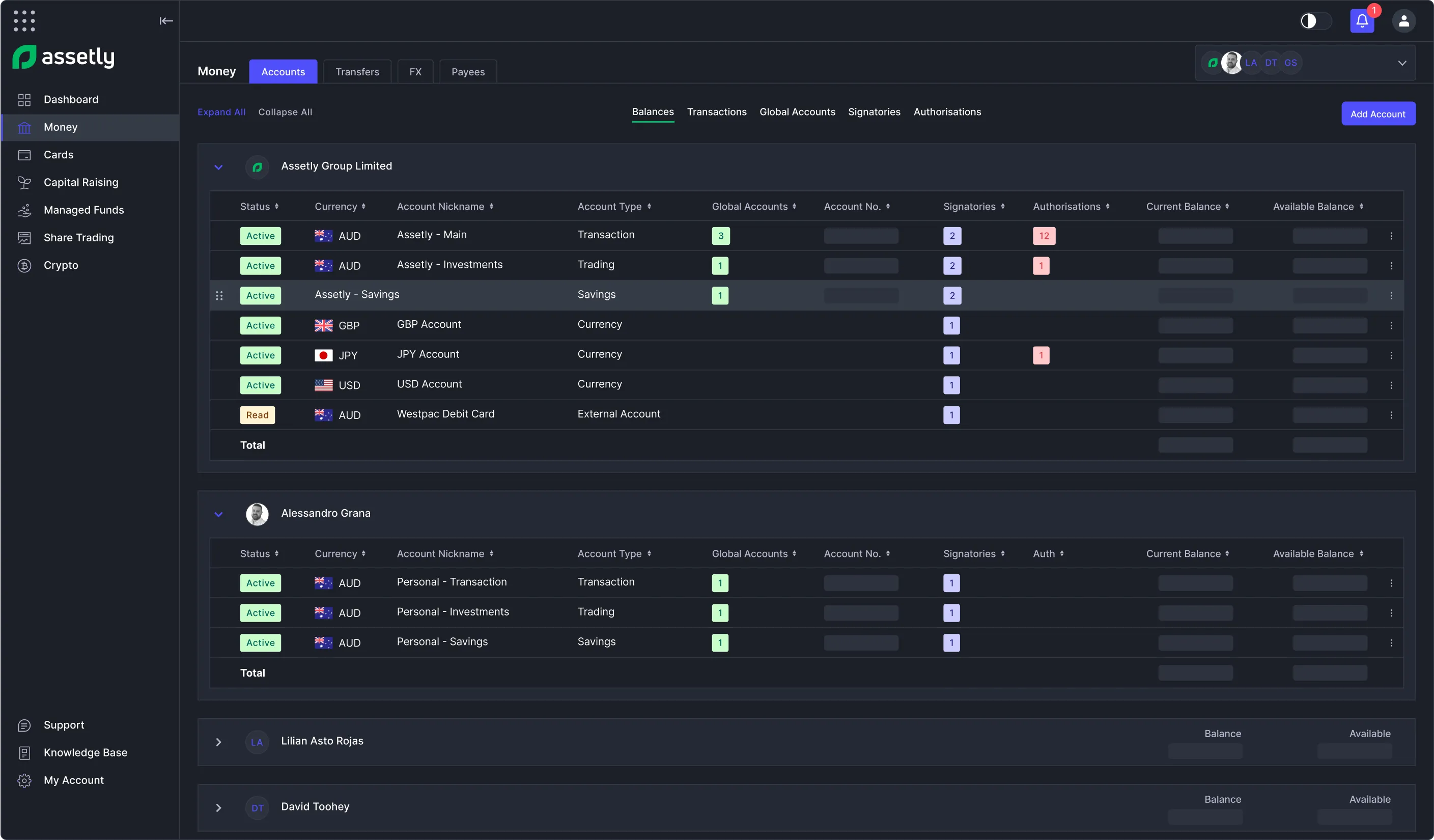

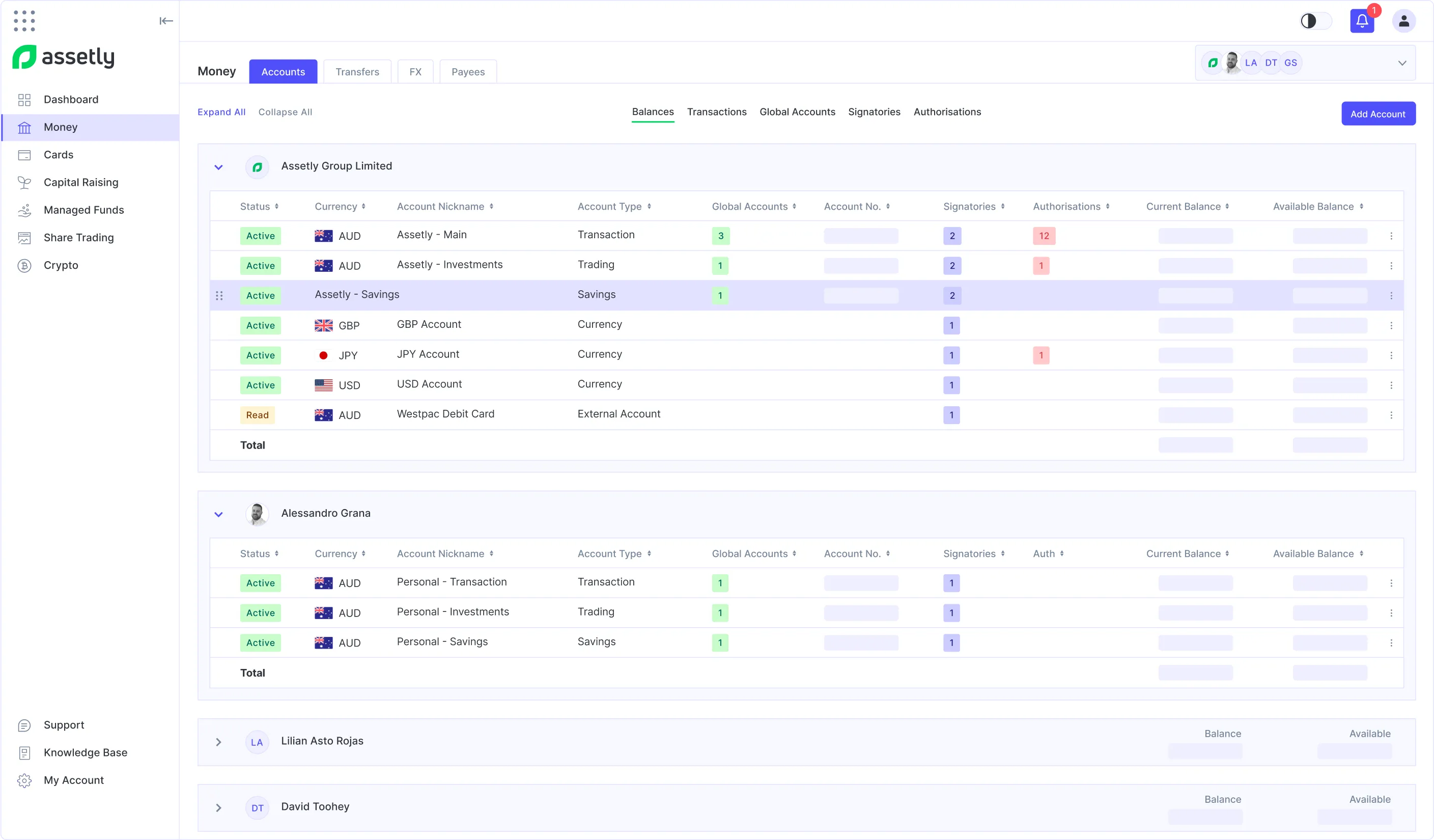

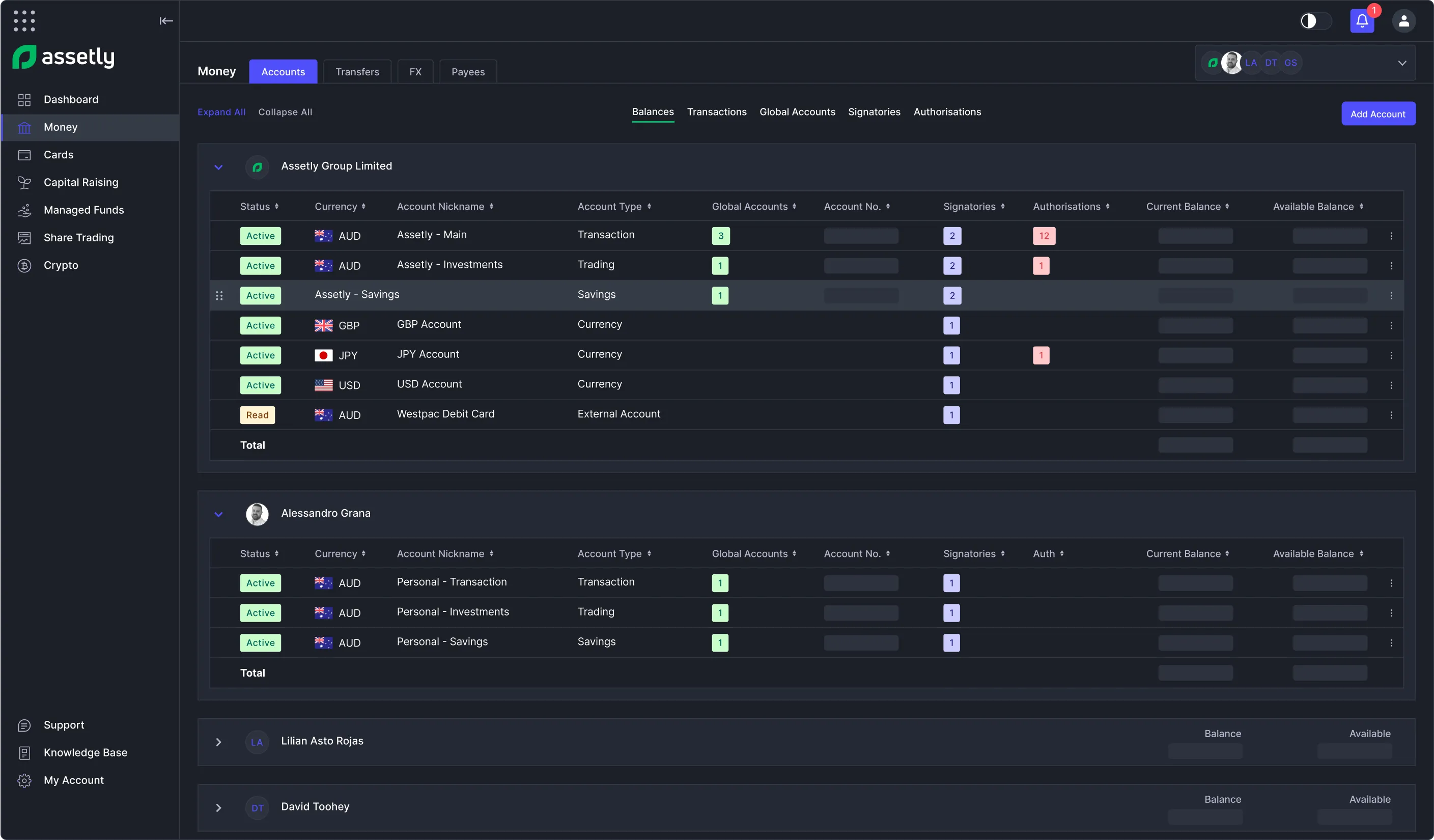

Multiple Legal Entities

Once you setup an account as an individual, you can add all your legal entity types from joint, business, trust or SMSF

Multiple Users

Assetly’s multi-tenanted architecture enables you to provide rules based multi-user access to your accounts

Consolidated Reporting

Transfer money, or buy and sell assets across any of your connected legal entities and generate consolidated reporting

Diverse Asset Classes

Access a wide range of investments through direct equity, managed funds, HIN based share trading and crypto

Native Cashflow

Integrated banking, cashflow, payments, cards, FX, investment registry and accounting

Wealth on Autopilot

Assetly’s natively integrated platform enables you to automate your money and investing like never before

Who is Assetly’s ecosystem being built for?

For investor types from Retail to Wholesale, to Family Offices and Institutions

Assetly’s investment platform caters towards retail and wholesale investors who want to build their wealth through an easy to use yet sophisticated set of financial products and platform features.

Credit reporting

Cash and payments

Listed equities

Private equity

Managed funds

Digital assets

For SMSF Trustees who want to take the pain out of SMSF compliance, cashflow and investing

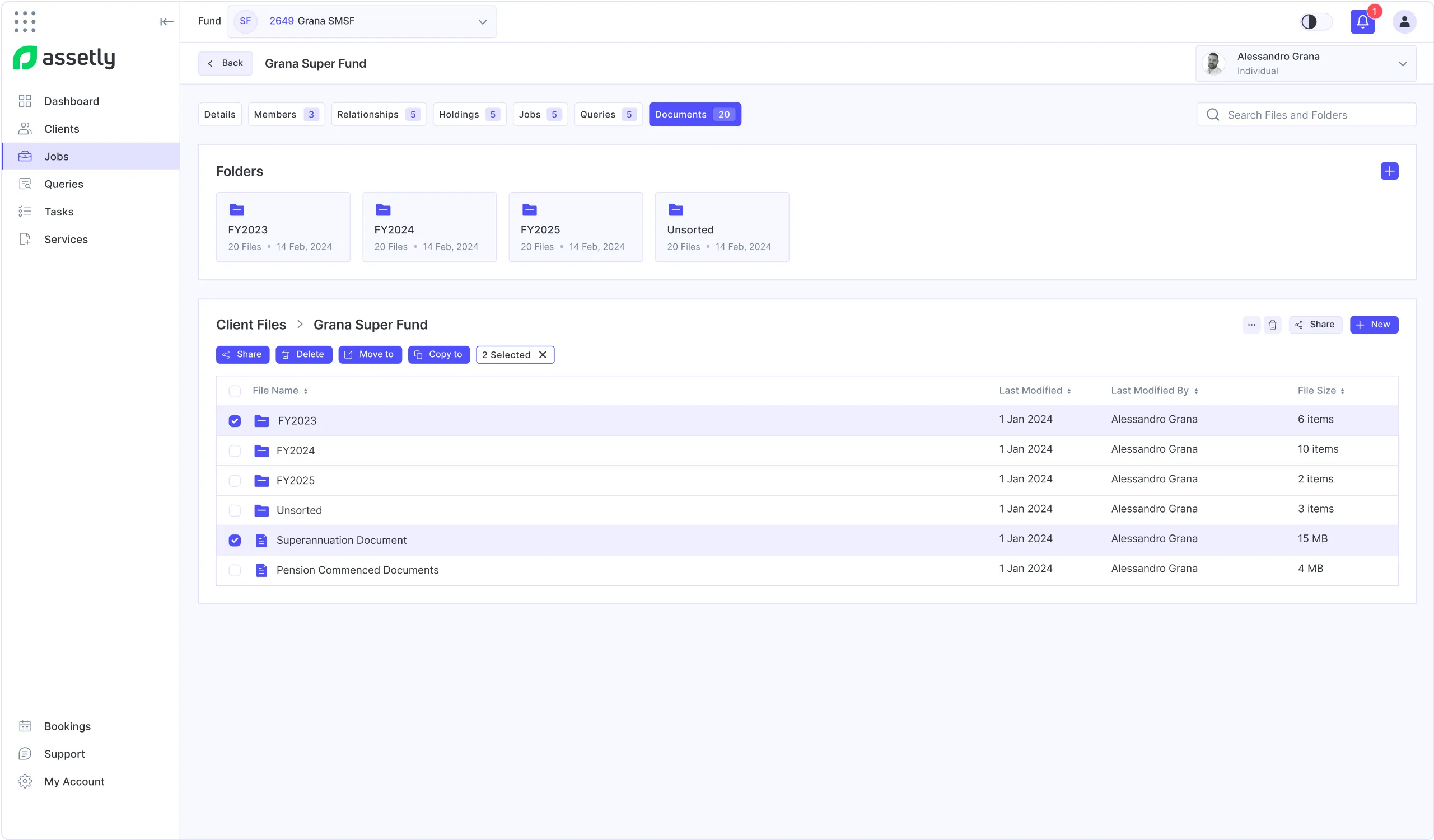

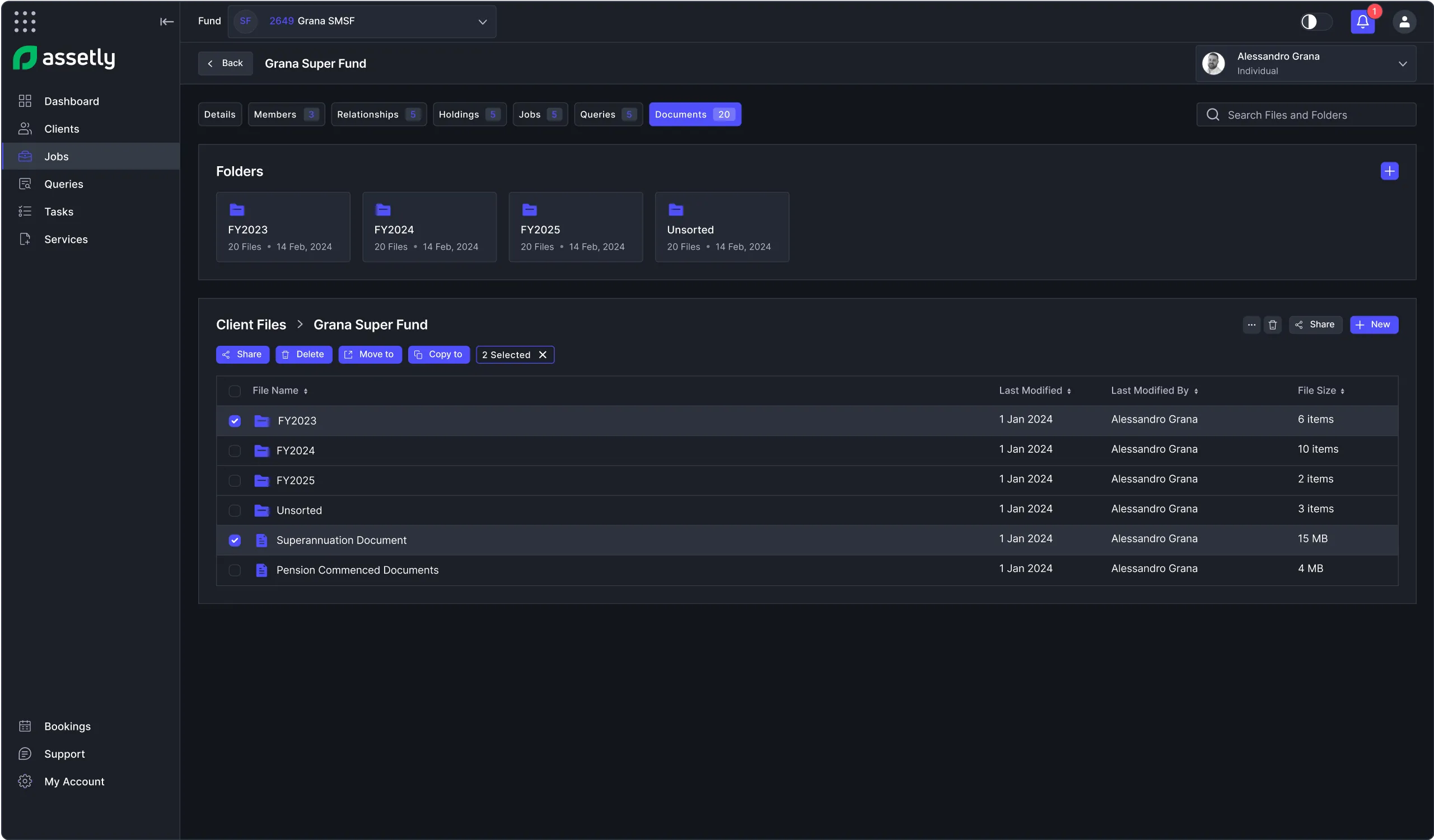

Assetly’s trustee versions of SMSF accounting and administration software is natively integrated into our investment ecosystem for streamlined reporting and compliance.

Trustee SMSF accounting

Trustee SMSF administration

SMSF audit

Advanced reporting

Legal documents

Tax return lodgement

For Accountants with multiple SMSF clients who want to accelerate processing and lower costs

Assetly’s professional SMSF accounting and administration software leverages artificial intelligence to streamline compliance, automate data entry, and significantly reduce manual workloads.

Professional SMSF accounting

Outsourced SMSF administration

Client communications & documents

SMSF Audit & tax return lodgement

Client CRM & billing

White-label version available

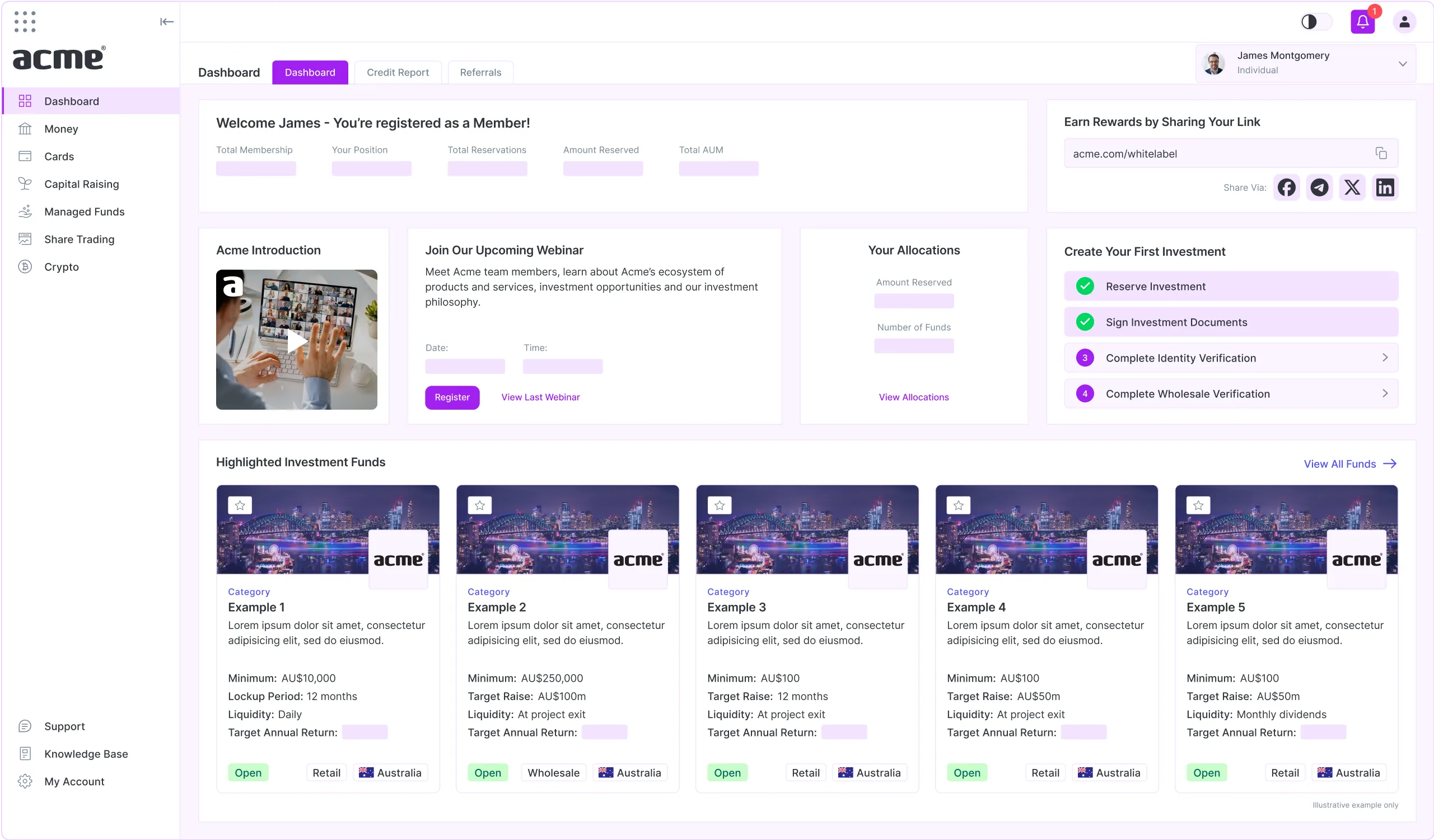

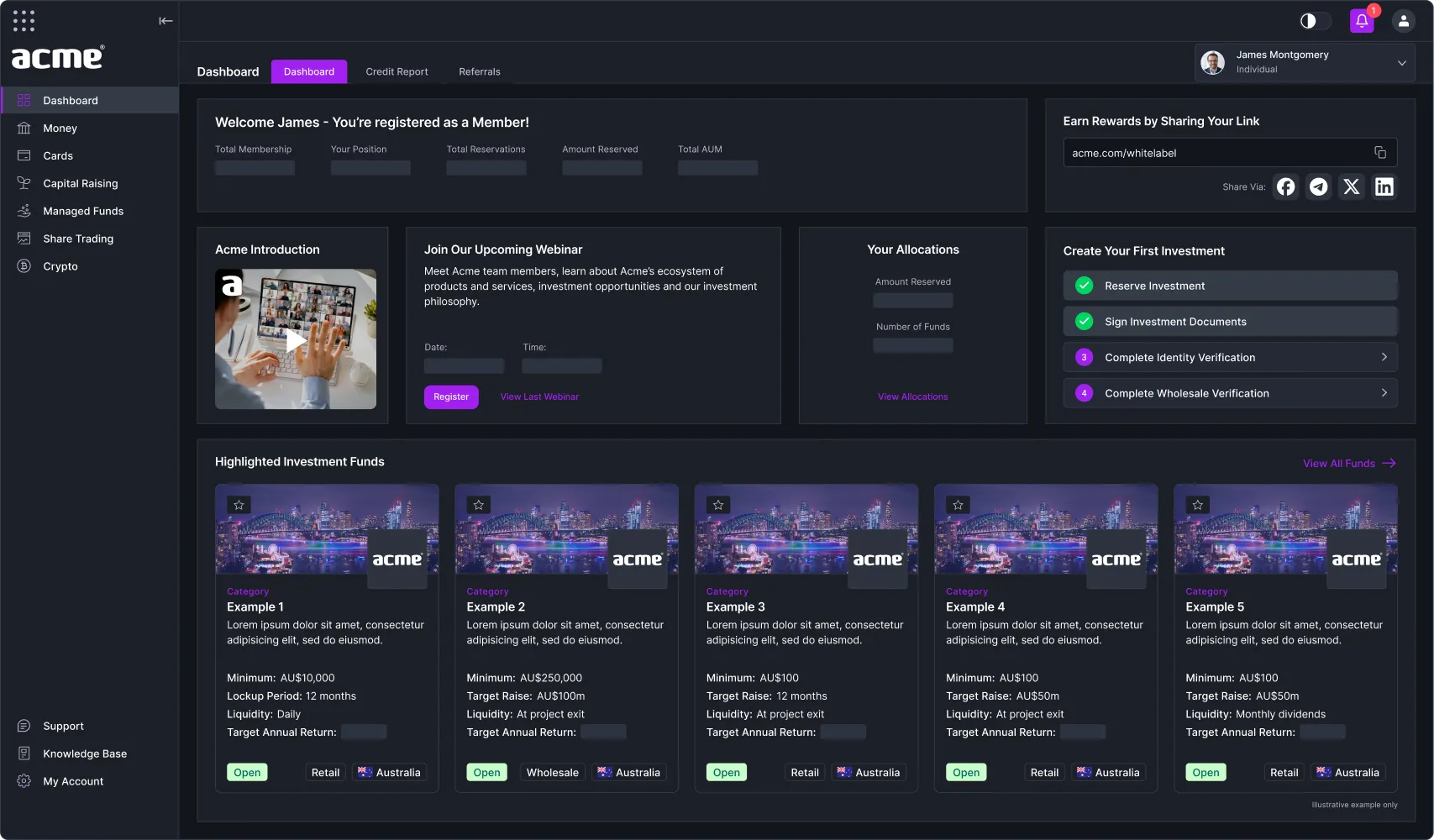

White-label solution for Financial Advisers who want to offer their clients an enhanced client experience

Assetly’s multi-tenanted white-label solution provides adviser networks with technology driven tools for bespoke client experiences and AI driven asset management.

Hyper-personalised portfolio management

Access to public & private asset classes

Automated client cashflow

Outsourced SMSF administration

Client CRM & communications

White-label version

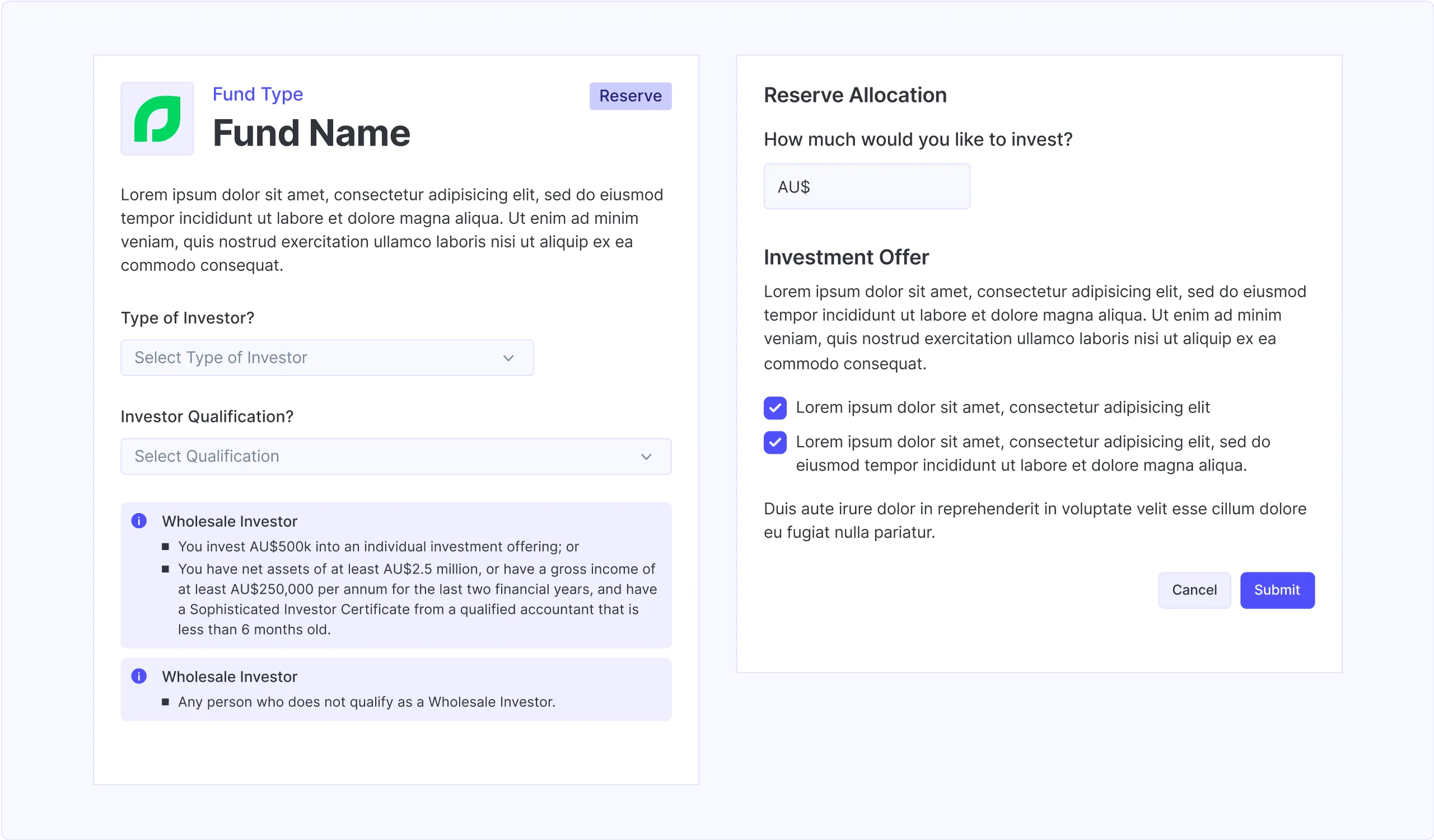

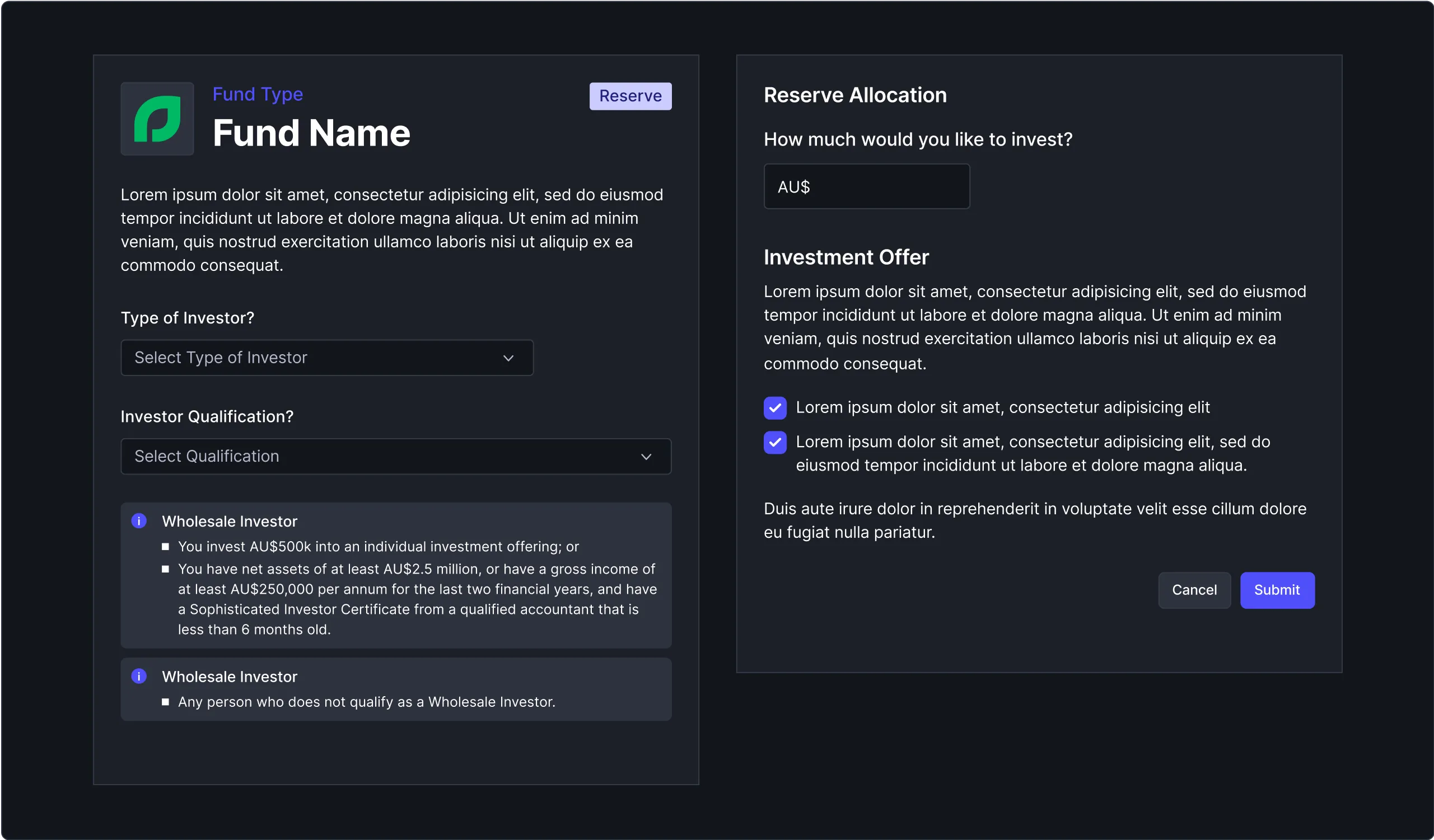

White-label solution for Fund Managers who want an end-to-end managed fund solution

Assetly’s fully integrated managed fund solutions enable fund managers to easily onboard new clients, manage client relationships and grow funds under management.

Multi-legal entity onboarding & compliance

Public & private marketplace options

Fund registry, administration & accounting

Client CRM & communications

Investment platform product modules

White-label version

For Startups and established businesses who want access to equity or debt capital

Assetly’s private capital marketplace empowers businesses of all sizes to access a diverse range of capital solutions, including equity, growth funding, and asset-backed debt facilities.

Capital marketplace

Raise equity funding

Hybrid debt and equity solutions

Debt facilities

Access investor networks

Acquisition and roll up vehicles

Articles

Startups

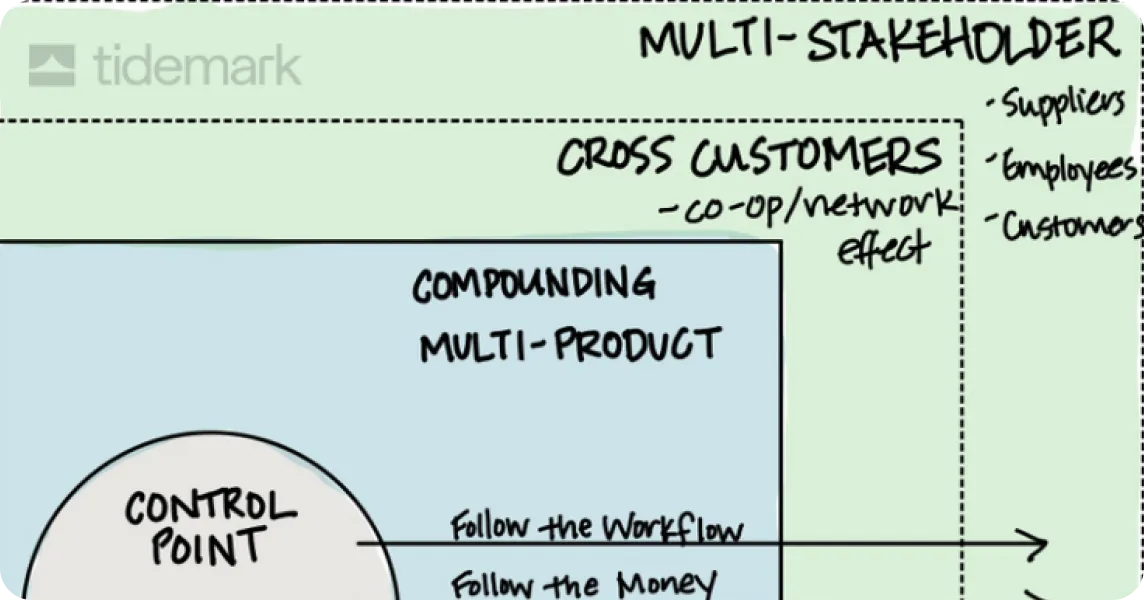

Tidemark

Platforms of Compounding Greatness

15 March 2025

Startups

TechCrunch

Parker Conrad says founders have been building software wrong for the last 20 years

14 August 2024

Startups

Tidemark

Born Multi-Product: A guide to the compound startup model

1 August 2024

Investing

Bain&Company

Private Asset Investing Desperately Needs New Market Infrastructure

6 July 2023

FAQ

Got questions? We’ve got answers.